On Friday afternoon, on the floor of the annual meeting of Berkshire Hathaway shareholders, I ran into my seatmate from the flight from Washington, D.C. to Omaha — a lovely woman working the Geico booth.

“Bill Murray is here,” she told me. I told her I’d keep my eyes peeled.

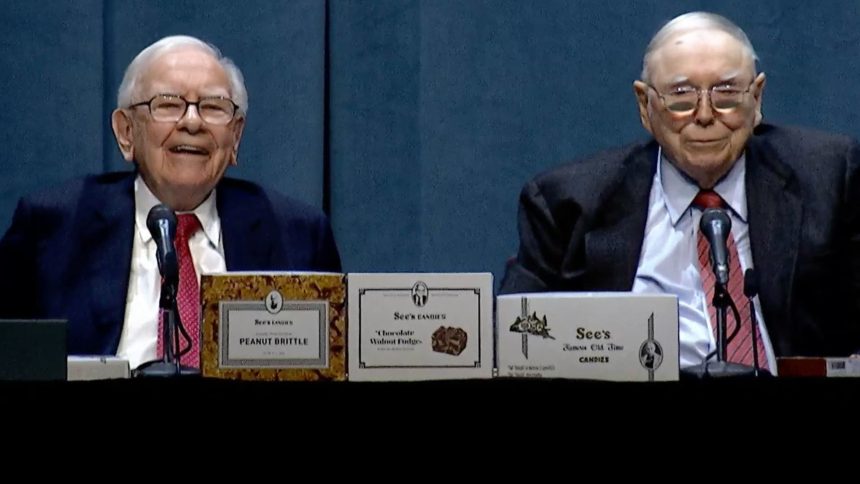

Of course, to the tens of thousands of shareholders who flock each year to Nebraska, Murray, or any other celebrity, is second fiddle to the real star of the show, Warren Buffett, and in years past his right-hand man Charlie Munger, who died in 2023.

Around these parts, the honchos at Berkshire do have one key thing in common with Murray: everyone who’s met them seems to have a story.

Earlier on Friday, I attended VALUEx BRK one of the many gatherings of investors that crop up around Omaha as sort of satellite Berkshire meetings. Run by Guy Spier, manager of the Zurich-based Aquamarine Fund, the event featured talks from a wide array of value investing enthusiasts, from investment managers to academics to authors to Munger’s longtime assistant Doerthe Obert.

Just about everyone who had encountered one of the Berkshire luminaries shared some of the wisdom they imparted. Here’s what you can learn from their stories.

Choose the right partner

Monsoon Pabrai, managing partner and portfolio manager of Drew Investment Research, recalled a lunch where she and her sister — both young girls at the time — sat on either side of Buffett. She took careful note of the three-and-a-half-hour conversation, but tends to return to one piece of advice.

“The one that always stuck with me was that he looked me and my sister in the eye, because we’re women, or young girls, and said, ‘The most important decision you make is who you marry,'” she said. “I think that goes for both partners in a marriage. It’s really important who you pick to be your life partner.”

Indeed, it’s advice that Buffett echoed at the shareholder meeting on Saturday.

In response to a question about advice everyone needs to hear, Buffett urged shareholders to think about the way they’d like their obituaries to read and to pursue life accordingly. “Certainly in my day it would have been marrying the person who could help you do that,” he said.

Give yourself some inspiration… and accountability

William Greene, author of “The Great Minds of Investing” spoke alongside photographer Michael O’Brien about the experience of profiling and photographing Munger.

An encounter with his friend, Berkshire board member Chris Davis, reminded him of a key piece of advice from Munger: surround yourself with images of your idols.

“Charlie told him very early on, put photos of people you admire in your office, because they’re people you don’t want to disappoint.”

Munger famously owned a bust of his hero, Benjamin Franklin, Greene noted. Greene, in turn, has a bust of Munger.

“I think this idea of structuring your physical environment to have pictures of people you admire is a really good hack. It’s tilting the odds of you behaving decently,” Greene said.

Make time for yourself

Gillian Segal, author of “Getting There: A Book of Mentors” spoke about her persistence in nailing down an interview with Buffett. After failing to get through to him remotely, she pinned him down at a charity event, where he agreed to lend her a few minutes of his time.

When it came time to schedule their meeting, Segal was in for a surprise.

“Once I had gotten in past [Buffett’s assistant], she was telling me all of the available times, and it was like, ‘OK, this week he’s available Monday,’ and it was a huge block of time. Tuesday, huge block of time, Wednesday, he has this. Thursday, huge block of time,” she says. “And I just realized he is who he is because he guards his time. And he has time to do the important things. He’s not overscheduled.”

Chances are, you don’t have nearly as many people as Buffett does asking for your time – or an assistant who is an expert at guarding it. But it’s an example that’s useful for anyone: To be successful in your career, you’ll need time to give it your undivided attention.

Stay in your lane

Munger’s longtime assistant Doerthe Obert told a litany of charming, personal stories about Munger, from his focus on his work to his attempts at dieting.

Her recollections of her working relationship with Munger are instructive for anyone who has employees. “We had such a good working relationship, and he just trusted me completely,” she said. “You’ll handle it – whatever it was. You’ll get it done.”

Trusting his assistant to do her work let Munger do his.

And when it came to the working relationship, Munger was happy to stay in his lane, too.

When I asked her what, if anything her boss taught her about investing, Obert demurred.

“He never talked to anybody about investing once,” she told me.

Never? Not even in passing?

“No. Because if he gave some advice and it [might not] work out,” she said. “If he loses some money, it’s not so bad. But if I would lose a lot? He didn’t want that responsibility.”

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.